Added: Jan 20, 2026

Last edited: Jan 20, 2026

Commercial Aircraft Engine Indicating Systems Aftermarket: Market Growth, Trends & Future Outlook

The Commercial Aircraft Engine Indicating Systems Aftermarket is gaining strong momentum within the global aviation maintenance ecosystem. Increasing air passenger traffic, extended aircraft service life, and the rising focus on cost-efficient maintenance solutions are driving sustained demand for aftermarket engine indicating systems. These systems play a vital role in ensuring engine safety, performance monitoring, and regulatory compliance across commercial aircraft fleets.

Market Size and Growth Outlook

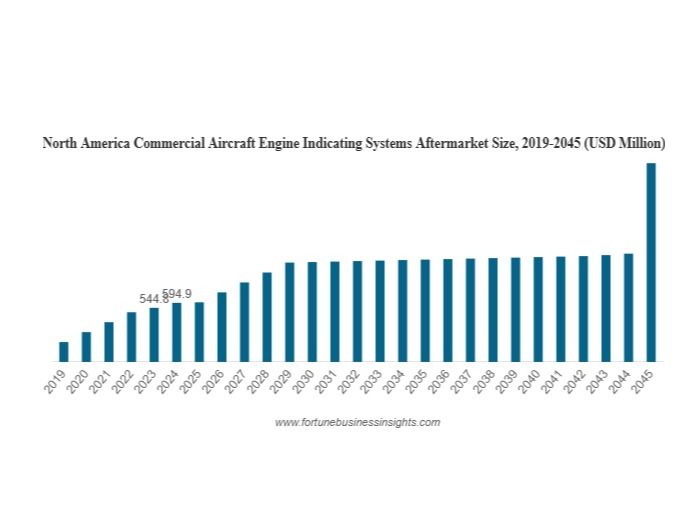

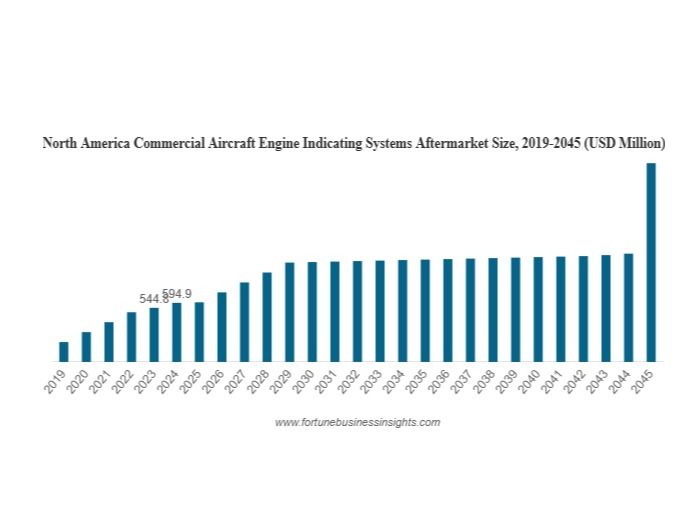

The global commercial aircraft engine indicating systems aftermarket was valued at USD 2,139.2 million in 2024 and is projected to reach USD 10,394.5 million by 2045. The market is expected to expand at a compound annual growth rate of 7.7% from 2025 to 2045, supported by rising fleet utilization and growing demand for reliable engine monitoring solutions.

Understanding Commercial Aircraft Engine Indicating Systems

Commercial aircraft engine indicating systems provide real-time data on engine health and operational performance. These systems enable pilots and maintenance teams to continuously monitor critical parameters and identify potential issues before they lead to failures.

Key components include:

Engine sensors for temperature, pressure, speed, and fuel flow

Engine oil systems such as pumps, filters, tanks, and coolers

Engine starting systems and associated control units

In the aftermarket, these systems are supported through maintenance, repair, overhaul services, and the supply of certified refurbished components. Aftermarket solutions help operators extend engine life while minimizing replacement costs.

Download Free Sample: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/commercial-aircraft-engine-indicating-systems-aftermarket-115024

Key Market Drivers

Growing Air Traffic and Fleet Utilization

Commercial aircraft are flying more frequently as global air travel demand continues to rise. Higher flight cycles accelerate wear and tear on engine components, increasing the need for regular maintenance and aftermarket replacements.

Cost-Effective Maintenance Strategies

Airlines are increasingly adopting used serviceable materials and parts manufacturer approval components to control operating costs. These aftermarket solutions offer a balance between cost efficiency and compliance with aviation safety standards.

Stringent Aviation Safety Regulations

Regulatory authorities mandate periodic inspections and performance monitoring of engine systems. This requirement ensures continuous demand for engine indicating system maintenance and replacement in the aftermarket.

Market Challenges

Despite strong growth potential, the market faces several challenges:

High maintenance and overhaul costs for complex engine systems

Supply chain disruptions affecting spare parts availability

Lengthy certification and approval processes for refurbished components

These factors can impact turnaround times and operational efficiency for airlines and maintenance providers.

Emerging Opportunities

Digitalization and Predictive Maintenance

Advancements in digital monitoring, artificial intelligence, and condition-based maintenance are transforming the aftermarket. Predictive analytics help detect engine anomalies early, reducing unplanned downtime and maintenance costs.

Rising Demand from Emerging Markets

Expanding commercial fleets in developing regions are creating new opportunities for aftermarket service providers. Airlines in these regions increasingly rely on aftermarket solutions to maintain growing fleets economically.

Segment Analysis

By Component

Engine oil systems account for a major share of the aftermarket due to frequent servicing requirements and their critical role in engine performance and reliability.

By Offering

Maintenance, repair, and overhaul services dominate the market, driven by routine inspections, preventive maintenance, and compliance with aviation safety regulations.

By Aircraft Family

The Boeing 737 family represents a significant share of aftermarket demand due to its large global fleet size and high operational utilization.

Regional Market Overview

North America leads the market, supported by a large commercial aircraft fleet and a well-established maintenance infrastructure.

Europe holds a strong position due to strict aviation regulations and widespread adoption of certified aftermarket components.

Asia Pacific is expected to witness the fastest growth, driven by rapid expansion of airline fleets and increasing passenger traffic.

Competitive Landscape

The market is highly competitive, with both original equipment manufacturers and independent maintenance providers actively expanding their aftermarket capabilities. Leading companies focus on service network expansion, digital maintenance solutions, and certified refurbished components to strengthen their market presence.

Information Source: https://www.fortunebusinessinsights.com/commercial-aircraft-engine-indicating-systems-aftermarket-115024

Conclusion

The Commercial Aircraft Engine Indicating Systems Aftermarket is set for long-term growth as airlines prioritize operational safety, cost optimization, and fleet longevity. With increasing adoption of predictive maintenance technologies and expanding commercial aviation activity worldwide, the aftermarket for engine indicating systems will remain a critical pillar of the global aerospace industry.