Added: Jan 06, 2026

Last edited: Jan 06, 2026

Industrial Packaging Market Overview (2024–2032)

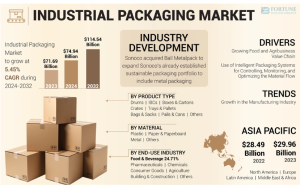

The global industrial packaging market is experiencing steady growth, driven by rising industrial activities, expanding global trade, and increasing demand for safe and durable packaging solutions. The market was valued at USD 74.94 billion in 2024 and is projected to reach USD 114.54 billion by 2032, growing at a CAGR of 5.45% during the forecast period.

Industrial packaging is essential for the storage, handling, and transportation of bulk goods across multiple industries such as chemicals, pharmaceuticals, food & beverages, construction, and agriculture. These packaging solutions are designed to protect products from physical damage, contamination, and environmental exposure throughout logistics operations.

Download Free Sample: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/industrial-packaging-market-107306

Key Market Drivers

Rising Industrial and Manufacturing Activities

Rapid industrialization, particularly in emerging economies, is significantly boosting demand for industrial packaging. The expansion of manufacturing facilities and export-oriented industries has increased the need for robust packaging solutions capable of handling bulk shipments.

Strong Demand from the Food & Beverage Industry

The food & beverage segment accounts for the largest share of the market, holding 24.71% in 2023. Growing consumption of packaged food products and strict food safety regulations are driving the adoption of high-quality industrial packaging that ensures hygiene, freshness, and extended shelf life.

Growth in Pharmaceutical and Chemical Industries

Pharmaceuticals and chemicals require reliable industrial packaging for safe storage and transportation of sensitive and hazardous materials. The globalization of pharmaceutical supply chains has further increased the need for secure, contamination-free packaging solutions.

Technological Advancements and Reusable Packaging

The integration of smart packaging technologies, including tracking systems and reusable packaging formats, is improving supply chain efficiency. These innovations help reduce material waste, lower logistics costs, and enhance product safety during transportation.

Market Segmentation

By Material

Plastic: Dominates the market due to its durability, flexibility, and cost-effectiveness. Widely used in drums, containers, and intermediate bulk containers.

Paper & Paperboard: Witnessing strong growth due to recyclability and increasing focus on sustainable packaging solutions.

Metal and Others: Preferred for heavy-duty applications requiring high strength and resistance.

By Product Type

Boxes & Cartons: Lead the market owing to ease of handling, customization options, and recyclability.

Drums & IBCs: Extensively used for storing and transporting liquids, chemicals, and hazardous materials.

Bags, Pallets, and Trays: Commonly used in warehousing, logistics, and bulk transportation.

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the industrial packaging market, accounting for approximately 41.79% in 2023. The region benefits from rapid industrial growth, strong manufacturing output, and expanding food, pharmaceutical, and chemical sectors, particularly in China, India, and Japan.

North America

North America is expected to reach USD 25.33 billion by 2032, driven by high adoption of reusable packaging, automation, and advanced logistics systems.

Europe

Europe shows stable growth due to strict environmental regulations and increasing adoption of sustainable and recyclable packaging materials.

Latin America and Middle East & Africa

These regions are witnessing gradual growth supported by expanding industrial infrastructure, improving supply chain networks, and rising demand for packaged industrial goods.

Market Challenges

Volatile Raw Material Prices: Fluctuations in the cost of plastics, paper, and metals affect production costs and profit margins.

Supply Chain Disruptions: Delays in raw material supply can impact manufacturing timelines.

Environmental Regulations: Increasing restrictions on plastic usage are pushing manufacturers to invest in sustainable alternatives.

Sustainability Trends and Growth Opportunities

Sustainability is becoming a major focus area in the industrial packaging market. Companies are increasingly adopting recycled, biodegradable, and reusable materials to reduce environmental impact and comply with regulatory standards. Automation and smart packaging solutions are also gaining traction to improve efficiency and reduce waste.

Key Companies Operating in the Market

Mondi Group

WestRock

Smurfit Kappa

Sonoco Products Company

DS Smith

Greif Inc

These companies are focusing on innovation, sustainable packaging development, and global expansion to strengthen their market presence.

KEY INDUSTRY DEVELOPMENTS:

December 2023 – Novvia Group, a worldwide provider of life sciences packaging, announced the acquisition of JWJ Packaging, a U.S.-based supplier of drum pails and other rigid container products. Based in Millstone Township, New Jersey, JWJ Packaging has been serving customers across the tri-state area with a diverse range of products and services.

Information Source: https://www.fortunebusinessinsights.com/industrial-packaging-market-107306

Conclusion

The industrial packaging market is set to witness consistent growth through 2032, supported by expanding industrial sectors, rising global trade, and increasing focus on sustainability. Companies that invest in advanced, durable, and eco-friendly packaging solutions are expected to gain a competitive edge in the evolving market landscape.