Added: Jan 05, 2026

Last edited: Jan 05, 2026

Civil Shotgun and Rifles Market – Global Industry Analysis, Trends & Forecast (2026–2034)

The global Civil Shotgun and Rifles Market is witnessing steady growth, supported by rising participation in shooting sports, increased hunting activities, and growing awareness around personal safety and home defense. The market was valued at USD 3.25 billion in 2025 and is projected to reach USD 4.83 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.5% during the forecast period.

Market Overview

Civil shotguns and rifles are firearms legally owned by civilians in accordance with national and regional regulations. These firearms are primarily used for:

Hunting and wildlife management

Recreational and competitive shooting

Personal security and home defense

Training and sporting activities

Commonly used calibers include .22 LR, .223 Remington/5.56 NATO, 7.62×39 mm, and emerging calibers designed for enhanced accuracy and reduced recoil. Manufacturers continue to focus on ergonomic designs, modular platforms, and improved safety mechanisms to cater to evolving consumer preferences.

Download Free Sample: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/civil-shotgun-and-rifles-market-114698

Key Market Drivers

Rising Focus on Personal Security

Growing concerns related to crime rates and personal safety have significantly boosted demand for civil firearms, especially in regions where civilian gun ownership is legally permitted. Shotguns and rifles are increasingly perceived as reliable tools for home defense, contributing to sustained market growth.

Growth in Shooting Sports and Hunting Activities

The increasing popularity of recreational shooting, hunting tourism, and competitive shooting events is driving market expansion. Shooting clubs, training centers, and sports federations continue to promote firearm sports, particularly in developed economies.

Market Restraints

High Ownership Costs and Licensing Procedures

The cost of firearms, coupled with mandatory licensing, background checks, training requirements, and maintenance expenses, poses a challenge for market growth. These factors can limit adoption, particularly in developing regions with strict regulatory frameworks.

Emerging Opportunities

Technological Advancements in Firearms

Innovation remains a major opportunity in the market. Manufacturers are introducing lightweight materials, advanced optics compatibility, modular accessories, and improved recoil management systems. Smart safety features and enhanced customization options are attracting both experienced shooters and new entrants.

Market Challenges

Stringent Firearm Regulations

Regulatory complexities remain one of the most significant challenges. Firearm ownership laws vary widely across countries and regions, creating compliance challenges for manufacturers and consumers. Changes in legislation can directly influence demand patterns and distribution strategies.

Market Segmentation Insights

By Caliber

Intermediate centerfire calibers hold the largest market share due to their versatility in hunting, sport shooting, and defense applications.

Pistol caliber firearms are expected to witness the fastest growth, driven by rising demand for compact and manageable firearms for self-defense.

By Operating Mechanism

Gas-operated firearms dominate the market owing to smoother operation, better recoil control, and higher firing accuracy.

Blowback-operated firearms are anticipated to grow rapidly due to their simple design, cost-effectiveness, and ease of maintenance.

By Application

Personal security and home defense represent the leading application segment, reflecting growing safety awareness among civilians.

Sports and competition shooting remain strong contributors, supported by professional leagues and recreational shooting communities.

By End User

Civilian users account for the majority of market demand, driven by recreational shooting and personal defense needs.

Private security firms also contribute significantly, particularly in regions with rising security concerns.

Regional Analysis

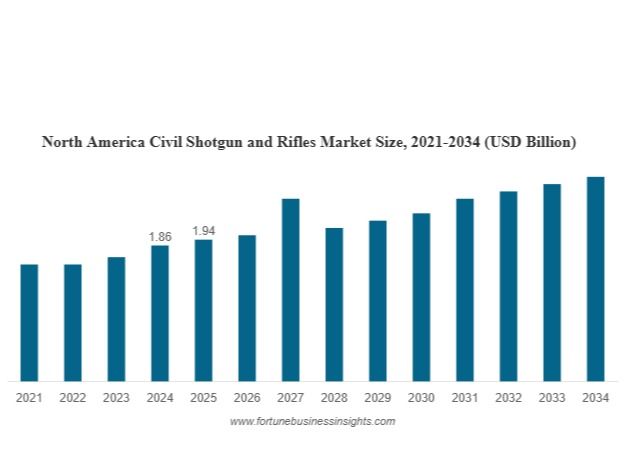

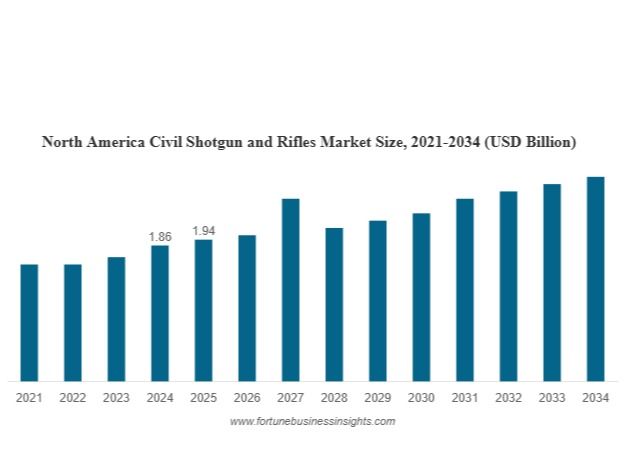

North America

North America holds the largest share of the global Civil Shotgun and Rifles Market, accounting for approximately 59.69% in 2025. High firearm ownership rates, a strong hunting culture, widespread shooting ranges, and the presence of major manufacturers support regional dominance.

Europe

Europe shows moderate growth, driven primarily by sports shooting and hunting activities. Although firearm regulations are stringent, controlled civilian ownership and organized shooting sports continue to support market demand.

Asia Pacific

The Asia Pacific region is expected to register notable growth due to increasing disposable incomes, expansion of shooting sports infrastructure, and gradual regulatory acceptance in select countries.

Latin America and Middle East & Africa

These regions are experiencing rising demand due to security concerns and increased investments in private security services. Civilian firearm adoption remains selective but steadily growing.

Competitive Landscape

The Civil Shotgun and Rifles Market is moderately consolidated, with key players focusing on product innovation, performance enhancement, and brand differentiation. Leading manufacturers emphasize:

Advanced ergonomics and lightweight materials

Modular and customizable firearm platforms

Strategic product launches and portfolio expansion

Prominent companies operate globally, catering to both recreational and security-focused consumers.

Recent Industry Developments

Introduction of lightweight rifles with advanced barrel materials

Launch of upgraded semi-automatic rifles with enhanced compatibility

Expansion of firearm portfolios targeting sport shooting enthusiasts

Development of modern platforms with improved safety and accuracy features

Information Source: https://www.fortunebusinessinsights.com/civil-shotgun-and-rifles-market-114698

Conclusion

The Civil Shotgun and Rifles Market is poised for consistent growth through 2034, supported by rising personal security concerns, expanding shooting sports culture, and ongoing technological innovation. While regulatory challenges and ownership costs remain key constraints, manufacturers focusing on innovation, compliance, and user safety are well-positioned to capitalize on emerging opportunities.

KEY INDUSTRY DEVELOPMENTS

September 2025: Springfield Armory released updated SAINT Victor V2 rifles and pistols in 5.56 and 7.62, featuring refined barrels, controls, and furniture. These rifles are presented by the company as upgraded AR-pattern platforms for civilian home-defense and range use.

July 2025, Palmetto State Armory launched the PSA SABRE ARV pistol-caliber carbine, a premium 9mm delayed-blowback semi-automatic rifle built on the AR platform as an application for civilian home-defense and PCC competition shooters in the mid-to-upper price tier.