Added: Sep 16, 2025

Last edited: Sep 29, 2025

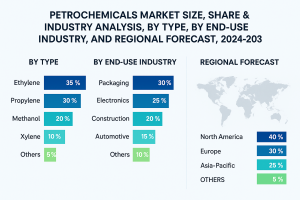

The global petrochemicals market is witnessing steady growth, driven by rising demand across industries and advancements in production technologies. According to Fortune Business Insights, the market was valued at USD 623.83 billion in 2023 and is projected to increase from USD 649.16 billion in 2024 to USD 900.91 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.2% throughout the forecast period. Among regions, Asia Pacific dominated the market in 2023, holding a commanding 52.16% share. The United States market is also set for strong expansion, with the petrochemical sector expected to achieve USD 105.76 billion by 2032, supported by government-backed recycling initiatives and sustainability programs.

Petrochemicals, derived mainly from natural gas, crude oil, and coal, form the backbone of several industries. They are crucial in the production of plastics, synthetic rubber, solvents, and numerous chemical intermediates. End-use industries such as electronics, automotive, packaging, and construction rely heavily on these materials to develop innovative products and meet growing consumer demand. With urbanization, industrialization, and lifestyle changes increasing worldwide, petrochemicals are expected to remain indispensable to modern economies.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/petrochemicals-market-102363

List of Key Players Mentioned in the Report:

BASF SE (Germany)

LyondellBasell Industries Holdings B.V. (Netherlands)

INEOS (K.)

Shell plc (K.)

SABIC (Saudi Arabia)

Reliance Industries Limited (India)

Mitsubishi Chemical Corporation. (Japan)

Dow Chemical Company (U.S.)

LG Chem (South Korea)

Chevron Phillips Chemical Company LLC. (U.S.)

China National Petroleum Corporation (China)

Maruzen Petrochemical Co., Ltd. (Tokyo)

Market Segmentation

By Type

The petrochemicals market is segmented into methanol, propylene, ethylene, xylene, and others.

Ethylene has historically dominated the market and continues to lead due to its extensive use in producing ethylene glycol, vinyl chloride, and polyethylene. These derivatives serve as essential raw materials for plastics, fibers, and packaging solutions.

Other types, such as propylene and methanol, are also witnessing strong demand in applications ranging from fuel additives to adhesives and coatings.

By End-Use Industry

Based on application, the market is categorized into electronics, automotive, construction, packaging, and others.

Packaging emerged as the largest segment in 2022, primarily fueled by the rising use of plastic packaging materials across both food and non-food sectors. Flexible packaging, bottles, containers, and films continue to be in high demand, particularly in emerging economies with booming retail and e-commerce sectors.

The automotive industry is another important consumer, using petrochemical-based products for lightweight vehicle components, tires, coatings, and interiors. Similarly, construction and electronics sectors are increasing their dependence on petrochemicals for insulation materials, cables, and structural applications.

Regional Insights

Asia Pacific remains the undisputed leader in the global petrochemicals market. Rapid industrial growth in China, India, and Southeast Asia, coupled with a robust automotive sector and expanding manufacturing activities, has strengthened the region’s dominance.

North America is showing significant progress due to technological advancements in shale oil extraction and hydraulic fracturing, which have enhanced domestic feedstock availability. This has boosted the region’s petrochemical production capacity, making it a strong global competitor.

Europe and the Middle East also contribute significantly, with investments in advanced facilities and integrated refinery operations supporting steady growth.

Market Drivers and Restraints

Drivers: The industry is benefitting from the expansion of the packaging sector, rapid urbanization, and the rising demand for consumer goods globally. Innovation in material science and growing adoption of plastics in diverse industries are also fostering growth.

Restraints: On the flip side, environmental concerns and the ecological impact of petrochemical products are posing challenges. Governments and organizations are increasingly regulating plastic use and encouraging recycling, which may restrict unchecked growth in the sector.

Information Source: https://www.fortunebusinessinsights.com/petrochemicals-market-102363

Competitive Landscape

The global petrochemicals market is highly competitive, with leading companies focusing on mergers, acquisitions, joint ventures, and technological innovations to enhance profitability and maintain market presence. Firms are also prioritizing sustainable production methods to align with global environmental goals.

Notable Development

In January 2024, LyondellBasell announced plans to acquire a 35% stake in Saudi Arabia’s National Petrochemical Industrial Company (NATPET) for more than USD 500 million. Backed by its Spheripol polypropylene technology, this acquisition is expected to provide LyondellBasell with access to competitive feedstocks while boosting its polypropylene production capacity in the Middle East.