Added: Sep 12, 2025

Last edited: Sep 29, 2025

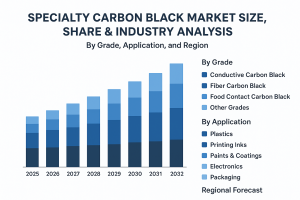

According to Fortune Business Insights, The global specialty carbon black market size was valued at USD 3.14 billion in 2024. The market is projected to grow from USD 3.31 billion in 2025 to USD 4.89 billion by 2032, exhibiting a CAGR of 5.7% during the forecast period. Asia Pacific dominated the specialty carbon black market with a market share of 57.00% in 2024.

The Specialty Carbon Black Market is witnessing robust growth, driven by rising demand across industries such as plastics, coatings, inks, and batteries. Unlike standard carbon black, specialty carbon black offers unique properties including enhanced tinting strength, UV protection, conductivity, and dispersibility, making it an essential material for advanced industrial applications. Specialty carbon black is a type of engineered carbon material designed with precisely controlled properties such as surface area, particle size, structure, and chemical composition. Produced through the regulated thermal decomposition of hydrocarbons, it differs from standard carbon black by offering advanced performance characteristics. These unique features make it ideal for demanding applications like conductive polymers, UV-protective coatings, and high-quality specialty inks.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/specialty-carbon-black-market-113665

What is Specialty Carbon Black?

Specialty carbon black refers to engineered carbon particles produced with precise control over parameters such as surface area, particle size, structure, and chemistry. Unlike commodity carbon black, specialty types are tailored for high-performance applications, offering benefits like conductivity, UV resistance, and enhanced color properties.

Key Market Drivers

Rising demand for high-performance plastics

Industries such as automotive, electronics, and packaging are adopting specialty carbon black to enhance properties like UV stability, conductivity, and durability.

Growth of electric vehicles (EVs) and electronics

EV batteries and advanced electronics require conductive and ultra-pure specialty carbon blacks to improve performance.

Sustainability and regulations

Growing environmental awareness and government regulations are encouraging the development of bio-based and recovered carbon black production methods that reduce emissions and reliance on fossil feedstocks.

Challenges & Restraints

High production costs due to the use of expensive feedstocks and advanced processing technologies.

Strict regulatory frameworks related to emissions, workplace safety, and carcinogenicity, increasing compliance costs for manufacturers.

Market Segmentation

By Grade: Conductive, Fiber, Food Contact, and Specialty Grades

By Application: Plastics, Printing Inks, Coatings, Batteries, Others

By End-Use Industry: Automotive, Packaging, Electronics, Construction, Textiles

Regional Insights

Asia-Pacific dominated in 2024 with a 57% market share, led by China’s large-scale manufacturing base and premium product demand in Japan and South Korea.

North America showed strong demand for advanced applications, particularly in electronics and automotive sectors.

Europe emphasized sustainable and regulatory-compliant grades, particularly for food contact and low-PAH applications.

Latin America and Middle East & Africa showed moderate growth, primarily relying on imports for high-end products.

Competitive Landscape

Major players shaping the specialty carbon black industry include:

Cabot Corporation (U.S.)

Birla Carbon (U.S.)

Mitsubishi Chemical Group Corporation. (Japan)

Continental Carbon Company (U.S.)

Tokai Carbon Co., Ltd. (Japan)

International CSRC Investment Holdings Co., Ltd (China)

Imerys (France)

Zaozhuang Jiarun Chemical Co., Ltd. (China)

Orion Engineered Carbons GmbH (Germany)

Beilum Carbon Chemical Limited (China)

Recent developments include Birla Carbon launching sustainable, battery-grade conductive carbon blacks and Cabot introducing masterbatches and reinforcing grades for EV tires that enhance tread durability and reduce rolling resistance.

Opportunities Ahead

Expanding use in EV batteries and charging infrastructure.

Scaling sustainable carbon black production through recovered materials and biomass-based feedstocks.

Growth in premium applications such as electronics, food packaging, and UV-resistant plastics.

The specialty carbon black market is projected to grow from USD 3.31 billion in 2025 to USD 4.89 billion by 2032, at a CAGR of 5.7%. Asia Pacific will remain the global growth engine, supported by rapid industrialization, rising EV adoption, and demand for both premium and cost-effective grades. The Specialty Carbon Black Market is poised for significant expansion as industries shift towards high-performance, sustainable, and technologically advanced materials. With its versatile applications in plastics, coatings, batteries, and inks, specialty carbon black is becoming a critical material for the future of automotive, electronics, and packaging sectors.

Information Source: https://www.fortunebusinessinsights.com/specialty-carbon-black-market-113665

KEY INDUSTRY DEVELOPMENTS

April 2025 – Birla Carbon announced to showcase advanced, sustainable carbon-based solutions at Chinaplas 2025, targeting high-performance applications in plastics, electronics, cables, and fibers. These innovations aim to enhance product durability, aesthetics, and conductivity.

February 2025 – Birla Carbon declared to introduce its latest battery-grade conductive carbon black, Conductex, at InterBattery in Seoul. Produced at its South Korean plant, it is designed for energy-intensive applications.