Added: Sep 12, 2025

Last edited: Sep 29, 2025

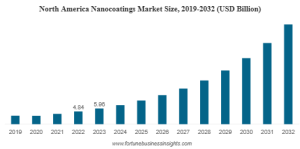

According to Fortune Business Insights, the global nanocoatings market was valued at USD 14.32 billion in 2023. The market is projected to grow from USD 17.54 billion in 2024 to USD 90.29 billion by 2032, registering an impressive CAGR of 22.7% during the forecast period. In 2023, North America dominated the market, accounting for 41.62% of the global share.

Nanocoatings are ultra-thin protective layers applied on surfaces to safeguard against dirt, dust, corrosion, water, bacteria, friction, and heat radiation. Increasing adoption across industries—particularly construction and automotive—is driving market expansion. Their role in promoting sustainability and energy efficiency further strengthens growth opportunities.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/nanocoatings-market-105023

Quick snapshot

2023 market value: USD 14.32 billion.

Forecast: USD 17.54 billion in 2024 → USD 90.29 billion by 2032.

CAGR (2024–2032): 22.7%.

2023 regional leader: North America (41.62% share).

List of Key Players Mentioned in the Report:

P2i Ltd (U.K.)

Nanovere Technologies LLC (U.S.)

Nanofilm Ltd. (U.S.)

ACTnano (Massachusetts, U.S.)

Nanophase Technologies Corporation (U.S.)

Tesla Nanocoatings Inc. (U.S.)

Cleancorp (Australia)

Report Coverage

This report delivers comprehensive insights into the global nanocoatings market, backed by extensive primary and secondary research. Market size estimations were derived through in-depth interviews with key stakeholders across the value chain, combined with access to both global and regional paid databases. The study provides reliable data at country, regional, and global levels, helping businesses make well-informed investment and strategic decisions.

Market Segmentation

By Type

Antimicrobial

Self-Cleaning (expected to hold the largest share)

Anti-Fingerprint

Anti-Corrosion

Others: includes photocatalytic, hydrophobic, superhydrophobic, anti-fouling, abrasion-resistant, thermal barrier, and anti-icing coatings

By Application

Building & Construction (dominant segment)

Automotive

Aerospace

Electronics

Marine

Others: includes medical, healthcare, food packaging, and energy applications

By Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Market Drivers and Restraints

Key Growth Driver

Strong demand from building & construction:

Nanocoatings are increasingly adopted in the construction industry due to their self-assembly properties and superior performance compared with conventional coatings. They provide effective protection for surfaces such as glass, concrete, marble, and limestone against staining, corrosion, abrasion, and other environmental factors.

Major Restraint

High equipment and technology costs:

Advanced machinery and processes are required for the effective application of nanocoatings. The relatively high investment costs may hinder adoption, particularly in cost-sensitive markets.

Regional Insights

North America – Market Leader

North America accounted for USD 3,188.6 million in 2020 and is projected to maintain its leading position throughout the forecast period. Growth in the region is strongly influenced by government subsidies, interest rate trends, construction activity, and consumer spending, all of which play a significant role in shaping GDP and driving nanocoatings adoption.

Asia Pacific – Fastest Growing Market

Asia Pacific is expected to secure a substantial share of the global nanocoatings market, supported by rapid growth in construction projects and industrial sector expansion. Rising infrastructure development and manufacturing activity will continue to stimulate demand in this region.

Europe – Strong Automotive Base

Europe represents another key region, underpinned by its well-established automotive industry. Countries such as Germany, Italy, France, and the U.K. remain major automobile producers, creating steady demand for nanocoatings to enhance durability, protection, and performance.

Competitive Landscape

The competitive environment of the nanocoatings market is shaped by strategic moves from key players, including:

Mergers and acquisitions to expand market reach.

Product launches to introduce advanced, sustainable coatings.

Collaborative partnerships to strengthen technology integration.

Agreements with government bodies to secure large-scale projects.

Such business developments directly influence market dynamics, either accelerating growth opportunities or reshaping the competitive balance.

Market highlights

Construction is a major growth engine due to demand for durable, low-maintenance surfaces and energy-saving finishes.

Automotive uptake is rising, particularly for abrasion-resistant and protective coatings.

Sustainability and lifecycle extension of products are key value propositions boosting market adoption.

Information Source: https://www.fortunebusinessinsights.com/nanocoatings-market-105023

Key Industry Developments

December 2023 – NANOFILM Technologies International expanded into the European market through a USD 9.9 million partnership with AxynTeC Dunnschichttechnik (Germany). AxynTeC specializes in coating solutions for industrial and medical applications using its patented thin-film technologies. With this collaboration, Nanofilm aims to strengthen its presence in Europe while offering advanced coating services and thin-film equipment solutions.

January 2020 – P2i introduced a new halogen-free barrier coating range designed for PCB-enabled OEMs. This sustainable and reworkable solution is targeted at the automotive and consumer electronics sectors. By eliminating hazardous chemicals and extending product lifespans, the new coating helps OEMs reduce their environmental footprint while enhancing durability and performance.