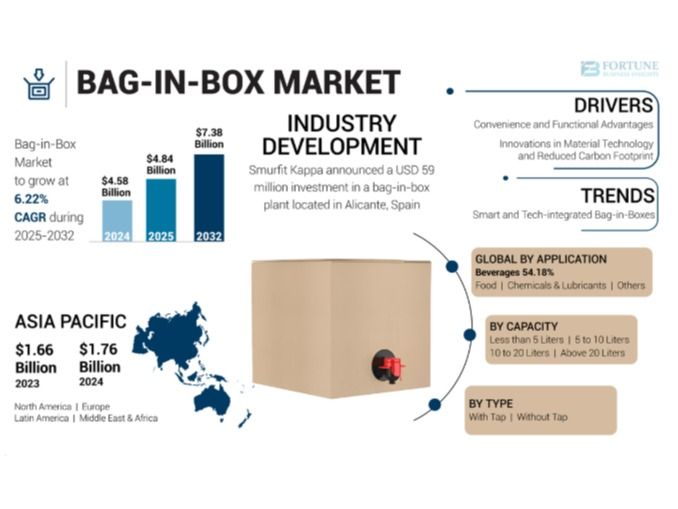

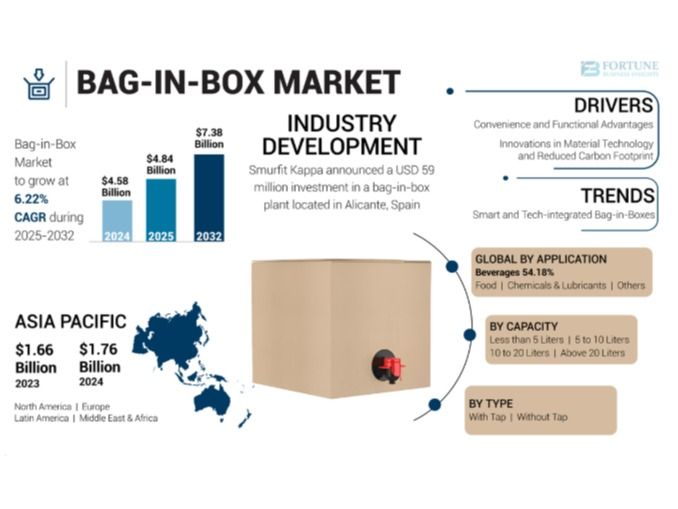

According to Forrtune Business Insights, In 2024, the global bag-in-box market was valued at USD 4.58 billion. It is expected to increase to USD 4.84 billion in 2025 and further reach USD 7.38 billion by 2032, registering a compound annual growth rate (CAGR) of 6.22% throughout the forecast period. The United States is poised to experience substantial growth in this sector, with its market projected to hit USD 1.82 billion by 2032. This upward trend is primarily driven by the rising need for affordable, lightweight, and eco-friendly packaging options, especially in the food and beverage sectors. In 2024, Asia Pacific led the global bag-in-box market, capturing a dominant share of 38.43%.

The bag-in-box (BIB) industry encompasses the manufacturing, distribution, and usage of flexible packaging systems designed for storing and dispensing liquid and semi-liquid products. This packaging format features a durable plastic bag—often constructed from multiple layers of metalized films or other plastic materials—housed within a robust outer box made of corrugated fiberboard.

Request a FREE Sample Copy of Bag-in-box Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/bag-in-box-container-market-102313

Competitive Landscape & Market Players

Top companies shaping the space include:

Amcor plc

International Paper

Scholle IPN Corp

Sealed Air Corporation

DS Smith PLC

Smurfit Kappa

Segmentation & Dynamics

Capacity

Less than 5 liters holds the largest share, favored for its compact, lightweight design and portability.

5 to 10 liters follows, commonly used in institutional or commercial settings where larger but manageable volumes are needed.

Type

With tap formats dominate, enabling precise pouring and reducing waste—especially valuable in foodservice and hospitality environments.

Without tap versions are more cost-effective and serve markets where simplicity and pricing are priorities.

Applications

The beverages segment—including wine, dairy, juices—is the largest end-use category, as bag‑in‑box packaging offers superior shelf life and sanitary dispensing.

Food products like edible oils benefit from protection against light and oxygen, extending freshness.

Other applications extend to chemicals and lubricants, and a variety of non‑food uses.

Regional Landscape

The Asia Pacific region led the market in 2024 with a share of 38.43%, reflecting the rapid urbanization and growing middle class in China, India, and Southeast Asia.

Additional perspectives:

Europe accounted for over 43.8% of revenue in 2023, driven by strong consumer demand in food and beverage sectors, particularly in wine markets.

The Asia Pacific region is also growing fast, with a CAGR of around 7.9% predicted through 2030.

Growth Drivers & Challenges

Key Growth Drivers

Convenience and cost effectiveness: Lightweight design, ease of transport, efficient space usage, and functional dispensing (especially with taps) enhance appeal.

Sustainability trends: Bag‑in‑box systems use less material and reduce transportation emissions compared to rigid packaging, aligning with eco-conscious consumer preferences and sustainability goals.

Smart packaging innovations: The integration of RFID, QR codes, and sensor technologies helps monitor freshness and streamline inventory—especially important for perishables.

Restraining Factors

Recyclability concerns: Multilayer materials used in bag‑in‑box packaging can be hard to recycle in areas without sufficient waste infrastructure.

High upfront investment: Specialized filling, sealing, and handling equipment can pose barriers for smaller manufacturers or entrants.

Notable developments:

In February 2024, Smurfit Kappa invested €54 million (approx. USD 59 million) to build a bag‑in‑box plant in Alicante, Spain, emphasizing sustainability.

Other players like Aran Group and WestRock are also expanding through acquisitions and new facilities to strengthen market presence.

Summary

AspectInsightMarket SizeUSD 4.84 billion (2025) → USD 7.38 billion (2032)Growth RateCAGR of 6.22% (2025–2032)Top RegionsAsia Pacific (38.4%), Europe dominates in food/bevApplicationsBeverages lead; food, chemicals followDriversConvenience, sustainability, smart packagingChallengesRecycling complexity, capital investmentLeading PlayersAmcor, Scholle IPN, Smurfit Kappa, etc.

Information Source: https://www.fortunebusinessinsights.com/bag-in-box-container-market-102313

KEY INDUSTRY DEVELOPMENTS:

KEY INDUSTRY DEVELOPMENTS:

February 2024 – Smurfit Kappa announced a €54 million (USD 59 million) investment in a bag-in-box plant located in Alicante, Spain. This investment is set to strengthen the sustainability of both the plant’s operations and the company’s product portfolio.

February 2024 – Aran Group announced the completion of the acquisition of a majority stake in IBA Germany from previous owner Liquid Concept GmbH (LC).

The bag-in-box packaging market is poised for significant growth, driven by sustainability demands, technological progress, and increasing adoption in beverage, foodservice, and industrial sectors. Europe currently leads the market, but Asia-Pacific is rapidly emerging as a growth engine. With ongoing innovation and strategic investments, the BiB format is becoming an essential component of modern packaging solutions.